Netflix's Roadmap to Growth Until 2030

An in-depth analysis of the challenges and opportunities facing Netflix as they strive for continued growth in a dynamic market.

In this case study, we will discuss the following things

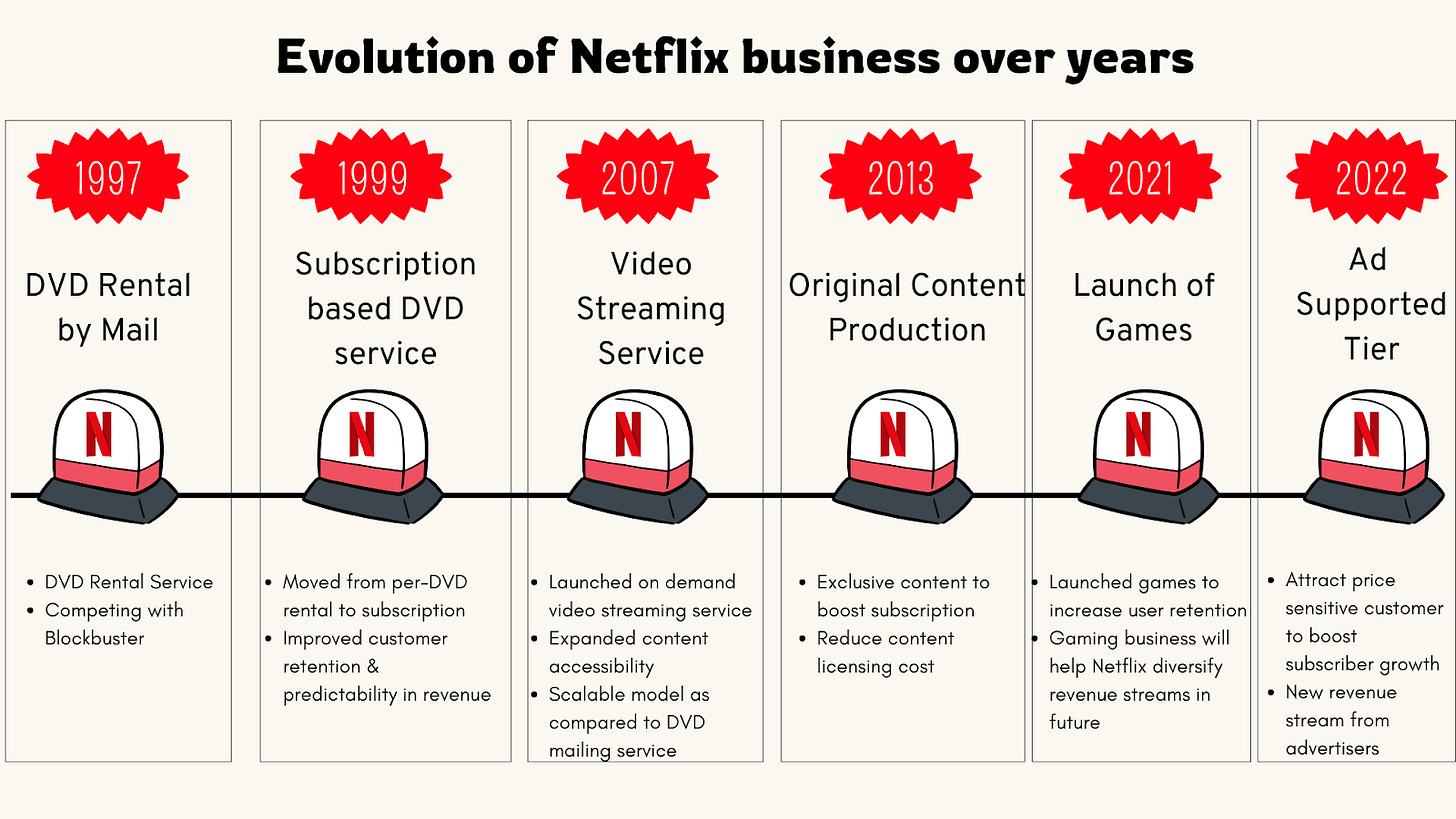

Netflix's evolution over the last 20 years through a strategic lens.

Why Netflix pivoted to the streaming business and how it found its Product Market Fit.

We will examine some of the cracks visible in the Netflix model, and how Netflix plans to generate growth till 2030

Initial years & pivot to streaming service -

Netflix was founded in 1997 by Reed Hastings and Marc Randolph, offering a novel DVD rental service where customers received movies by mail. This model capitalized on the emerging popularity of DVDs over VHS tapes, offering customers a convenient alternative to brick-and-mortar rentals like Blockbuster. The service allowed users to rent movies without late fees, using a subscription model that mailed DVDs directly to their homes. By 2008, Netflix had achieved $1 billion in revenue, significantly impacting competitors and becoming the largest client of the US Postal Service.

Everything else seems to be falling place, but the model had chinks in place, which made it non scalabale. Let’s deep dive into the top two reasons why the model was not scalable.

The number of customers served was capped by DVD inventory

Since the movies were distributed in the form of a DVD, the maximum number of customers served can’t be higher than the DVD inventory of Netflix. And predicting the right inventory mix was a headache. Imagine a new Harry Potter Movie is coming and all movie buffs are looking forward to seeing the previous parts of the movie to get warmed up. The question Netflix faced was how many Harry Potter DVDs to onboard before the release and what to do with those DVDs when everyone is excited to see the newly released movie.

Now imagine this complexity when you have 10,000 movie titles to manage for $1mn customers? A classic forecasting problem ensured that Netflix was not able to scale this model beyond a certain scale

Netflix's proposition was convenient but not highly convenient

While the idea of your favorite movie getting delivered at your doorstep looks extremely convenient, imagine the amount of planning that you will have to do to get your favorite movie delivered at your doorstep. Depending on the time you are looking to watch the movie and the expected shipping time, you need to raise the request with Netflix. Imagine that you have successfully planned it, but the DVD of the movie you are looking to watch is out of stock.

Okay, as a consumer, I am ready to go through all this hassle, but one end YouTube has already set the proof of concept that the future lies in on-demand streaming.

Netflix was smart enough to sense these limitations and shift its focus to launching the video streaming service platform in 2007 ,and what happened after was history.

A successful product market fit led to a decade of insane growth -

As Netflix has cracked the right product market fit for the movie-on-demand business, the next decade was all about growth. In little more than a decade, the annual revenue of Netflix has increased by a whopping 10 times.

Now, let’s also spend some time understanding how Netflix unlocked this stupendous growth after finding the right PMF.

The north star metric of Netflix is the annual subscription revenue, which is an output of how many subscribers Netflix has and what is the revenue every subscriber is bringing.

To increase the annual subscription revenue, Netflix has tried to optimise the following levers -

Increase the number of subscribers: To increase the number of subscribers, Netflix has used the following strategies -

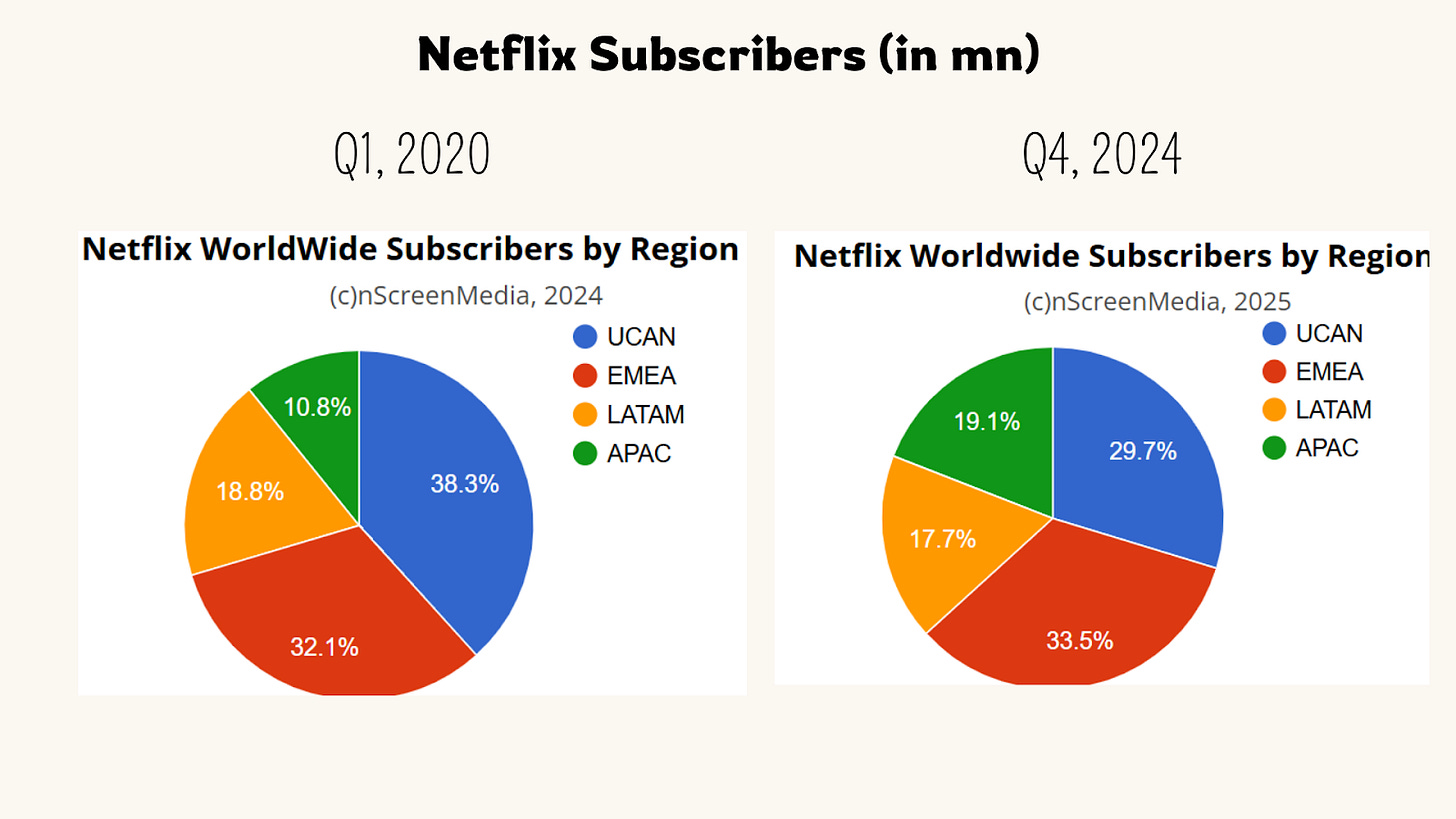

Geographical Expansion

Lower-tiered pricing to attract value-conscious customers

Increase the subscription revenue per customer: To increase the subscription revenue per customer, Netflix has -

Onboarding of fresh content every passing week

Creating exclusive content in-house

Increase the price of subscription plans as Netflix became famous

Is Netflix's growth still firing on all cylinders?

Okay, so everything is going great so far. The global pandemic events, such as COVID, have further accelerated the adoption of Netflix, but in the early 2020s, Netflix started seeing cracks in the model.

We know that Netflix has two ways of increasing its subscription revenue: a) either increase the subscriber base b) increase the subscription charges collected per customer.

As long as the subscriber growth is healthy, Netflix shall ideally have no issue in increasing the prices of its subscription plans. Increasing subscription prices might lead to churn of some of the older customers but as long as new customers are compensating for the churn, the annual subscription revenue of Netflix keeps on increasing.

But what if the subscriber growth dwindles?

The US and Canada are the markets with the highest revenue per customer for Netflix. But, it is very difficult for them to add more consumers in these markets. A study suggests the market holds about 132mn households. Out of these households, 84mn have cable connections, and 75mn of them are Netflix subscribers. Assuming Netflix has reached most of the affluent users, now they will have to find ways to onboard low-affluent users.

Though the overall number of Netflix subscribers is increasing, a significant portion of this growth is coming from emerging regions, where Netflix doesn’t have very strong pricing power. If this is happening, Netflix has to find ways to increase its subscribers, but how are they thinking about it? Let’s find out.

How is Netflix finding its growth mojo?

Launch of Ad supported tier -

To bring more subscribers onboard, Netflix sought the proven route - to bring an ad-based tier. This means that you can pay a lot less than the premium plans, but in return, subscribers will have to watch ads intermittently in their content.

To no surprise, the ad tier was an absolute hit. Though Netflix don’t reveal the exact numbers but as per their recent management commentary, in 2024, 55% of new sign-ups came from the ad tier, wherever available (Ad tiers were not launched worldwide in 2024)

This initial success is a strong proof of concept and there will be no surprises if Netflix makes the ad-supported tiers worldwide, specially in regions where the profit pools are not so strong, e.g. India.

Netflix Games -

In 2021, Netflix also launched games on their platform. Even though there exists a myriad of game companies, the idea behind launching games was to drive engagement & retention.

With so many popular IPs available, Netflix thinks that these IPs (shows like Stranger Things) once converted to games, can increase the engagement & retention of their subscribers.

Although games as an offering showing a lot of growth but in terms of adoption, it is not meaningful at this point. A study suggests that only 1% of Netflix users were playing games on their platform in 2023.

Right now, Netflix subscribers can play games at no additional cost as it comes along with their subscription package, but if this bet plays well, it will be interesting to see in the future if Netflix launches an additional tier which will allow users to play games in addition to streaming their favorite content. Hence the retention tool of today might emerge as a strong revenue-generating source tomorrow.

Key strategic takeaways from the case study

Backward Integration brings cost advantage & creates a defensible moat - At scale, backward integration can create defensible moats for the business. In this case, Netflix has started producing its own content to bring down the licensing fee. Any piece of content once produced can be used for a lifetime. Exclusive content keeps the users hooked to Netflix

Use pricing as a growth strategy - The pricing strategy can unlock significant growth for an organisation. Netflix, in this case, has subsidised the cost of watching for low-income users but coupled it with an advertising-based revenue.

The same strategy is followed by many other players. Some players follow the reverse of Netflix’s template, for example YouTube has always filled in your watch experience with ads hence subscriber growth was never a challenge. But they are increasing their revenue per viewer by charging users to have an ad free watching experience

Product Market Fit is not perennial - With the technological shifts, the mode of distribution changes and hence a company needs to be adaptable. Netflix was able to make the right move with the rising internet penetration, unfortunately, Netflix’s older rival, Blockbuster, was not adaptable and went bankrupt in the year 2010.

For More Such Detailed Case Studies

Be the Top 1% PM | YouTube | Cohort & Courses | Crack PM Interview

Enhance your Product Management Craft

AI Product Management Mastery | Product Talk Podcast

About Author

- |