In this article we will understand -

What is Rapido’s business model, and how is it challenging Uber’s dominant position?

What are the core strengths of Rapido’s strategy that are driving its market growth?

What are the potential pitfalls of its business strategy, and how can Rapido navigate these challenges for long-term success?

If you like our work, you can support us here

Ride-hailing is not a new business model in India. Ola started their operations in 2010 after the emergence of Uber in the Western world. The mobility model in most of the Indian cities was broken. The convenience of booking a ride on your app and getting at your doorstep saw a fast product market fit, propelling both Ola and Uber onto a remarkable growth trajectory.

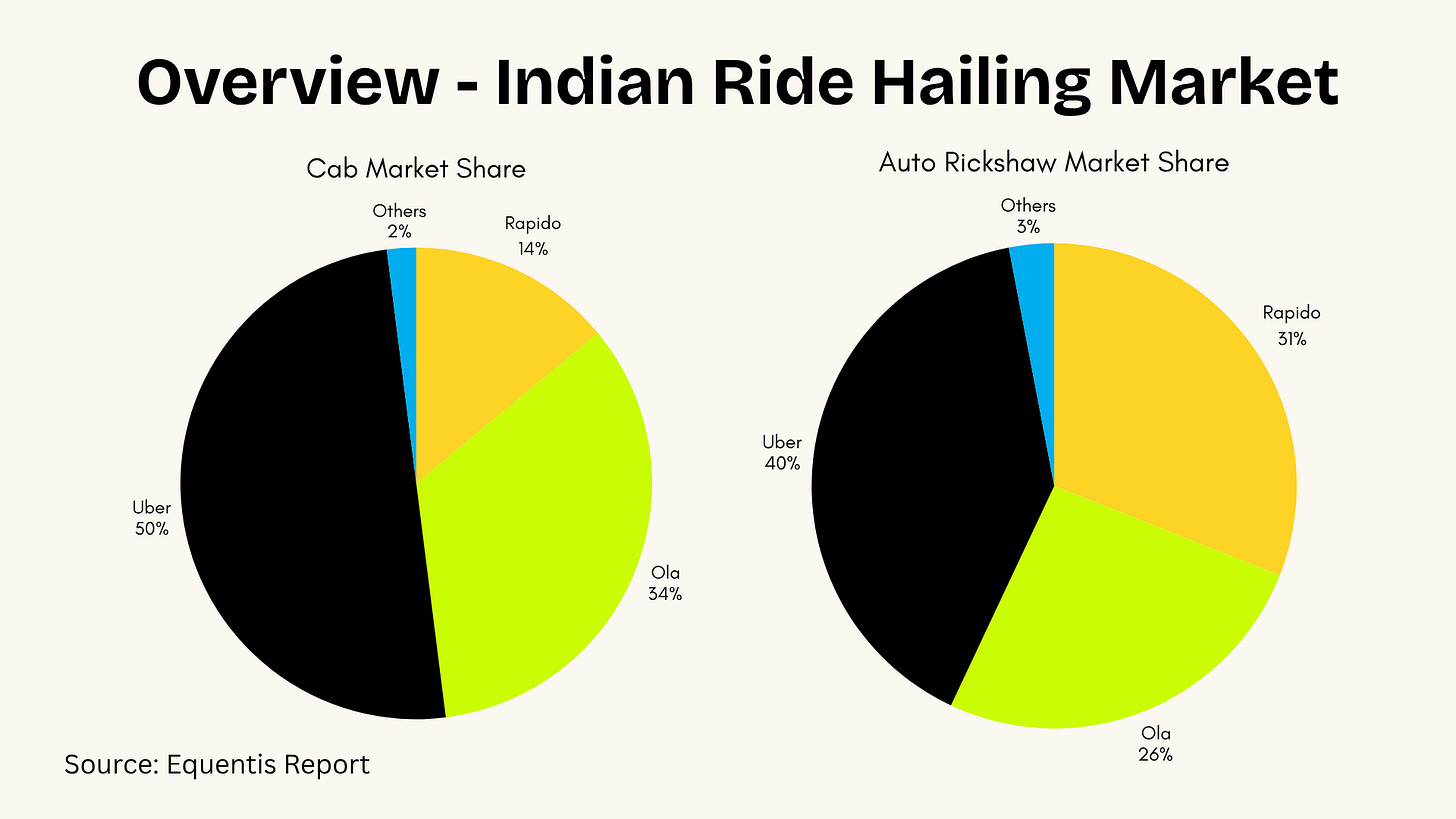

Fast forward to today, and the competitive dynamics have shifted dramatically. While Uber still leads the market, Rapido has notably displaced Ola to capture the second-largest market share (in auto rickshaws). This disruption raises critical questions: what factors contributed to Rapido's ascent, and is Uber's long-standing dominance now under threat?

Business Model of Ride-Hailing Marketplace

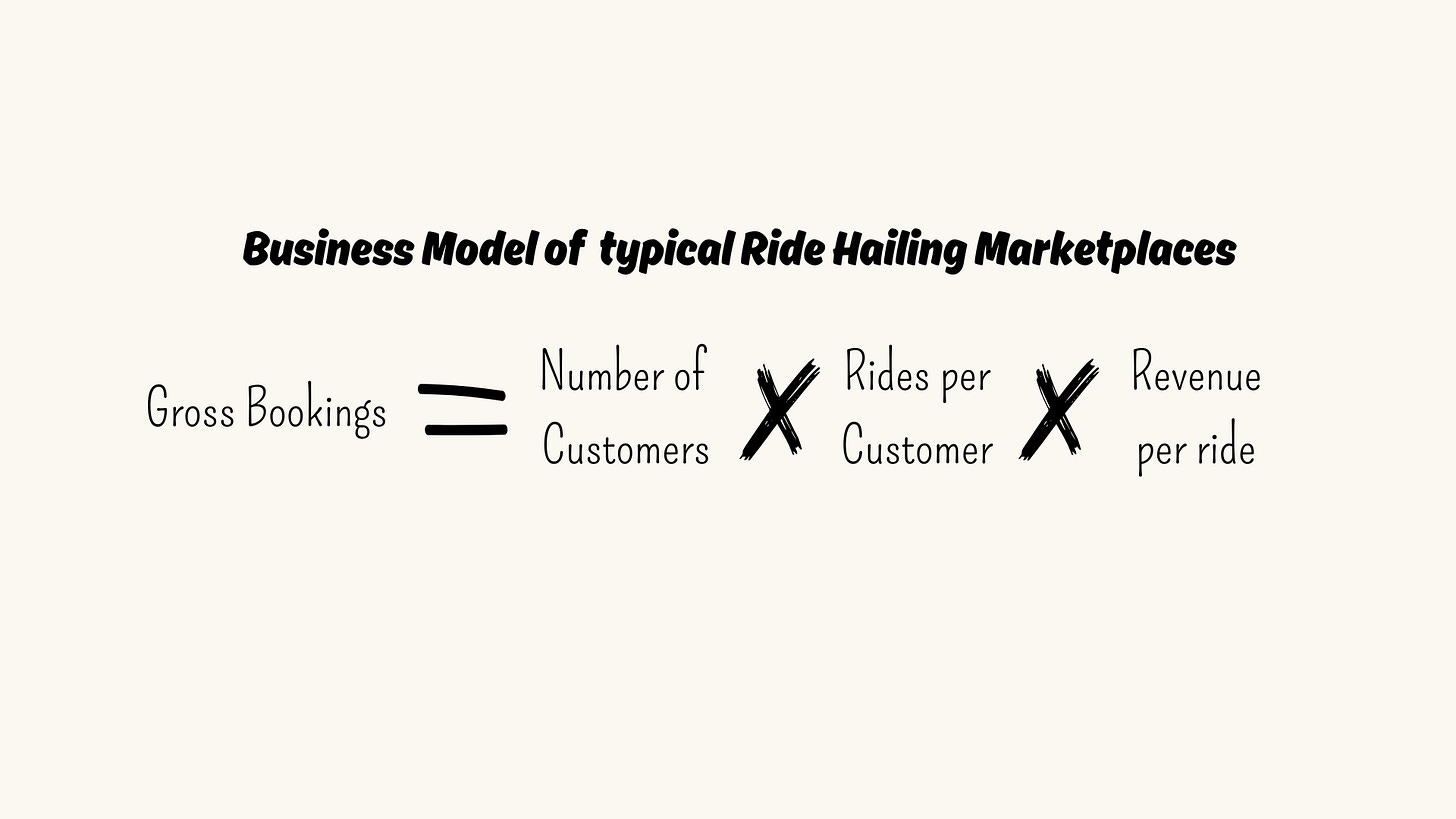

At the very start, the ride hailing platforms adopted a very simple model - Become a true marketplace by effectively matching the ride providers (drivers) with the ride takers (commuters). For every ride happening on the platform, charge a commission (%age value of ride fare). Their primary goal was to increase the gross bookings every month, quarter & year.

The above equation makes it evident that there are multiple ways to increase gross booking revenue: acquire more customers, increase revenue per customer, or encourage customers to take a higher number of rides. Supply—specifically, the drivers offering rides—impacts two of these important levers. A sufficient supply of drivers will attract more customers and enable them to take more rides on the platform.

Supply the secret sauce of scaling market place

Onboarding drivers is the biggest challenge for any ride-hailing platform. This is because driving requires a specific skill, and drivers provide the most important asset: a vehicle. Consequently, without a robust supply of drivers, a platform cannot activate the flywheel for ride bookings. (For most platforms, creating demand is relatively easier than building supply.)

More supply of drivers means the platform can serve a higher number of customers. It can also serve every customer more than once.

Hence, to woo a lot of drivers on the platform, Uber started rolling out unimaginable incentives to the drivers. Of course, these incentives were not sustainable in the long term.

As years went by, Uber slowly started reducing the commissions to the drivers, leading to a high driver churn rate, slowing the overall growth in terms of the number of completed rides on the platform.

The slowdown in the growth of completed rides wasn't a challenge as long as the market was a duopoly. Uber offset this by boosting its gross booking revenue through price increases for consumers. In addition, the company raised its commission per ride, thereby securing higher top-line growth year over year.

Rapido & its subscription model of supply

Rising ride prices & a higher commission were not a win-win situation for the customers & the drivers. Customers have to cough up higher prices, and a higher commission was making the deal bitter for drivers.

Subscription model caps Rapido’s topline

While the subscription model really helps Rapido in gaining an edge over supply but it has some downsides, which are going to play more prominently in the longer run.

How can Rapido break this topline shackle?

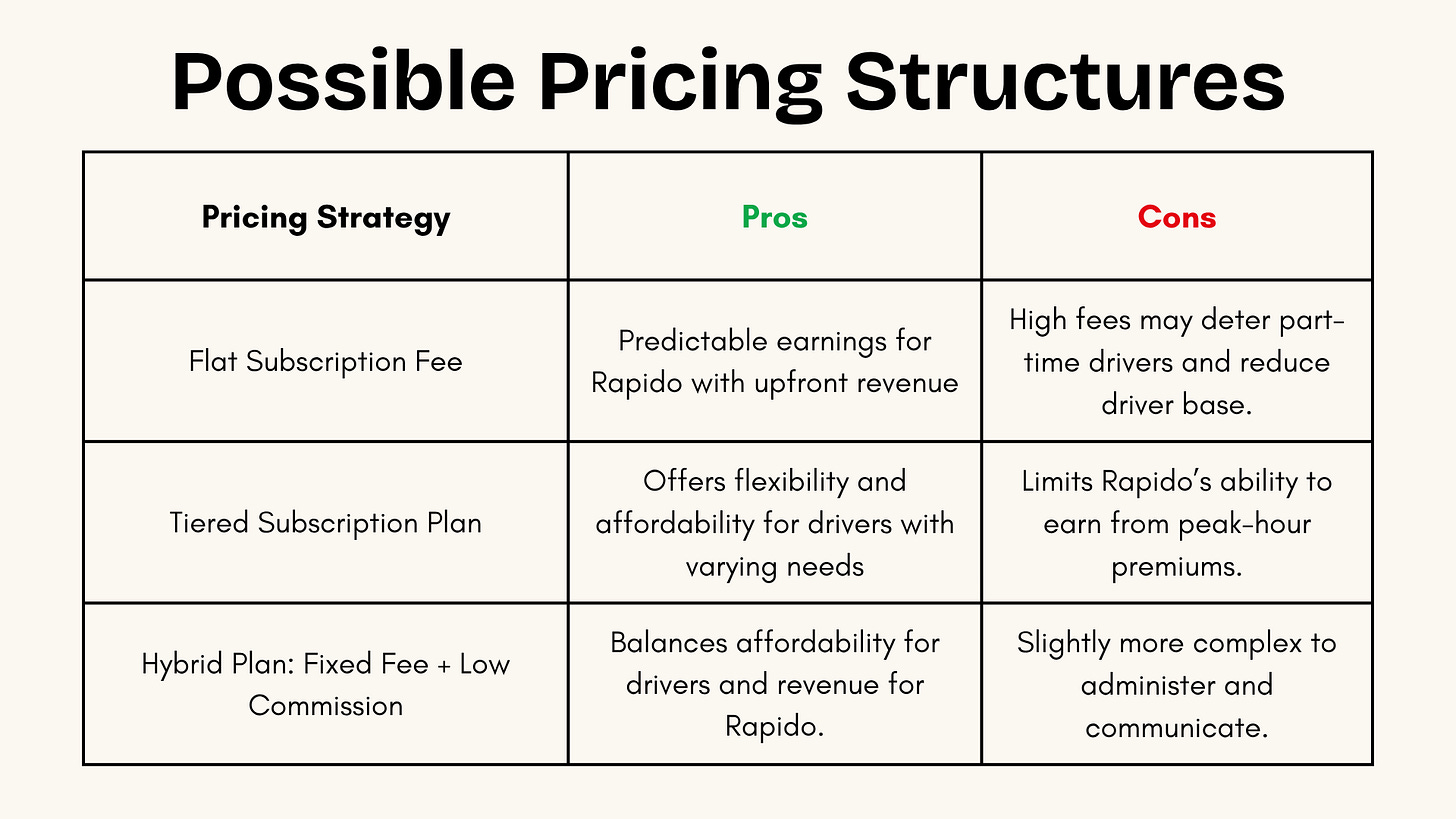

One argument can be made that, as time progresses, Rapido can also start increasing the subscription fee to access its platform. The con of this strategy will be that a very high subscription fee will dissuade many part time drivers from seeing Rapido as a source of earning. Hence, the overall number of active drivers will start reducing.

In addition to tweaking the pricing structure, it will be no surprise if Rapido starts tinkering in other logistics use cases such as parcel delivery, food delivery, or even becoming a third party logistics provider for quick commerce.

For More Such Detailed Case Studies

Be the Top 1% PM | YouTube | PM Cohort & Resources | Crack PM Interview | AI/Tech for Everyone

About Author

Shailesh Sharma! I help PMs and business leaders excel in Product, Strategy, and AI using First Principles Thinking. For more, check out my Live cohort course, PM Interview Mastery Course, Cracking Strategy, and other Resources